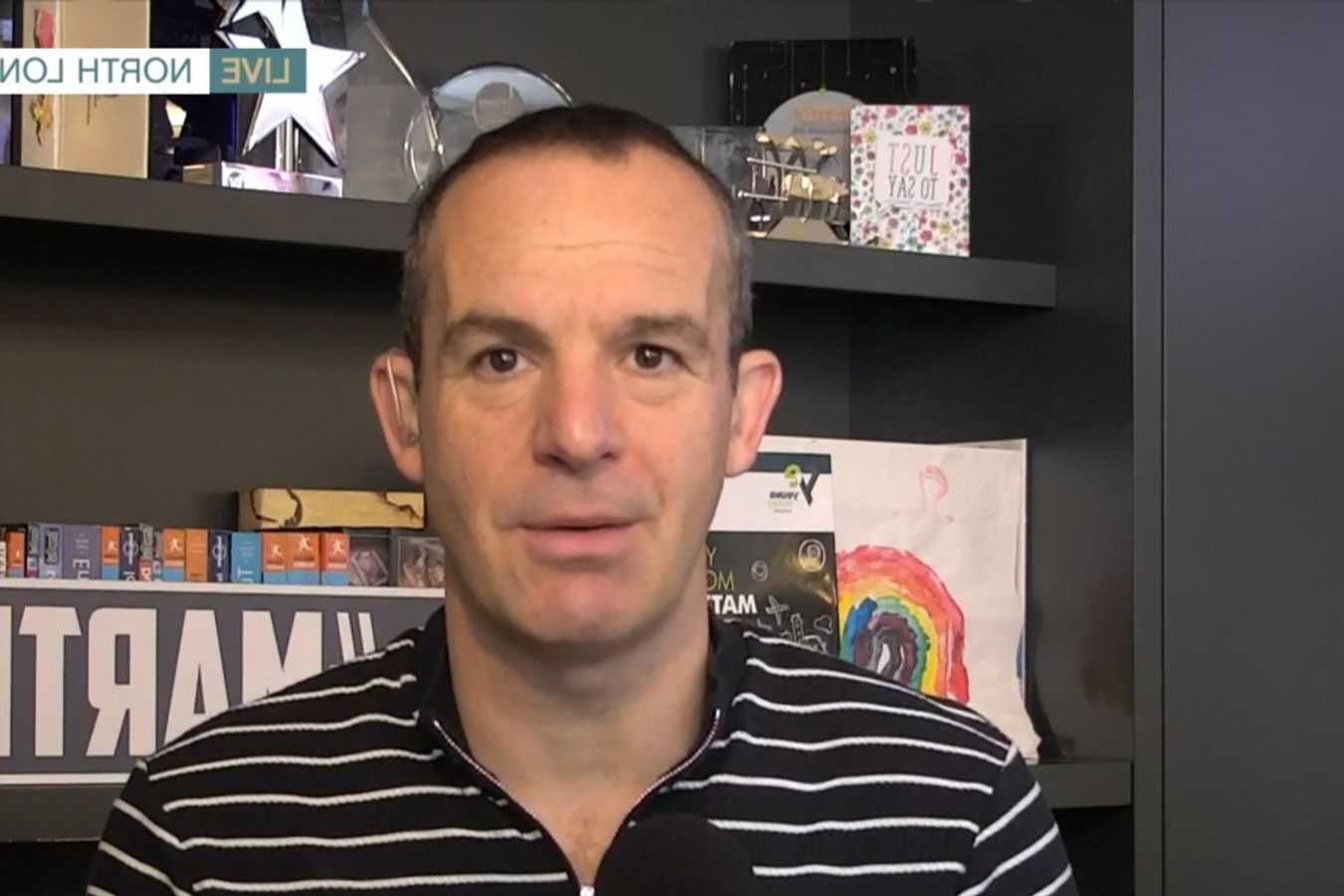

BRITS wanting to put away some cash could save thousands of pounds with money saving tips from Martin Lewis.

The MoneySavingExpert founder's advice has included how to save on everyday bills like Netflix and Council Tax,through to claiming back money from your bank.

We took a look at the top tips Martin Lewis has shared this year which have proved popular among Sun readers – and they are ones you can still take advantage of today.

Millions of people tune in to the trusted expert's TV show on ITV – The Martin Lewis Money Show – and read his MoneySavingExpert newsletter every week.

All together we calculated that the savings for 2021 already add up to a whopping £9,243.

While not everyone will be able to take advantage of all the savings, even just one of the tips could save you some money, and here we go through who could save on what, and how.

1. Apply for £5,000 Green Homes Grant vouchers

It's not often that the government gives away free money and that's why Martin is urging people to get Green Home Grant Vouchers while they can.

The scheme offers up to £5,000 to make your home more energy efficient.

It's for homeowners in England and will cover energy-saving measures that are either insulation or low carbon heat, like cavity wall insulation.

This scheme does have some catches and uptake has so far been low, but if you're considering home improvements to make your home greener, then check your eligibility first

“If this is for you, I’d get on with it, check it out now,” Martin said.

Here's his comprehensive guide to the scheme, including how it works and how to check your eligible.

What can the Green Home Energy grant be spent on?

The vouchers will be for homeowners in England and will cover energy-saving measures that are either insulation or low carbon heat in the first instance.

Insulation measures include:

- Solid wall

- Under-floor

- Cavity wall

- Flat roof

- Room in roof

- Insulating a park home

Low carbon heat measures include:

- Air or ground source heat pump

- Solar thermal (solar panels which can be used for heating water)

- Biomass boilers

If you use the voucher for any of the measures above, you can also use it to cover the following:

- Draught proofing

- Double or triple glazing when replacing single glazing

- Secondary glazing when in addition to single glazing

- External energy efficient doors when replacing single glazed or solid doors installed before 2002

- Heating controls

- Hot water tank thermostats and insulation

The voucher does not cover:

- A new extension or conversion

- Insulating a conservatory which has no fixed heating

- installing a new fossil fuel boiler such as gas, oil or LPG

2. Claim £125 back if you're working from home

With most offices remaining closed under coronavirus lockdown measures many people have been left working from home.

Martin has reminded everyone that they can claim tax back to help cover the extra expense of using your home as an office – like having the heating on all day.

Most taxpayers can get back £62.40 for the year, even if it's just a single day you've worked from home.

While for people who pay tax at the higher rate, it's £124.80.

You don't get a cash pay out, instead your tax code is changed so you pay less tax equivalent to the amount of tax you get back.

Nearly two million Brits have already claimed and it could not be easier.

Here, Martin explains how there's a simple tool to apply.

3. Knock hundreds of pounds off your car insurance bill

Martin revealed how you can slash hundreds off your car insurance bill ( even if your policy isn’t up for renewal yet)

One neat trick for saving money he advises? Start hunting 20 to 26 days before your policy runs out when it is up for renewal.

According to the finance guru, any later than this and you’re seen as a “higher risk”.

But with rising prices, Martin has urged everyone to shop around – even if they're mid-way through a policy.

Here's MoneySavingExpert's guide to getting the best deal.

4. Claim back £1,000s from your bank

Banks could owe you thousands of pounds for two reasons, Martin said.

The cash is available to customers who've either been mis-sold packaged accounts or where bank charges put you in financial difficulty.

Martin said: "The first is for packaged bank accounts. They are those where you pay a £10-£15 monthly fee in return for insurance."

If you chose it and it's right for you, it's usually not a problem, Martin explained on The Martin Lewis Money Show.

However, "if you were told you had to get it, you were probably mis-sold", he added.

Another way to reclaim cash from your bank is if your bank's charges caused you financial hardship.

Martin said: "This is much less big than it used to be, but you can still put in a claim."

One viewer told the ITV show she managed to get a £1,400 payout from NatWest after paying for a packaged account for 10 years.

Here's MoneySavingExpert's guide to reclaiming bank charges.

How to save on broadband and TV bills

HERE’S how to save money on your broadband and TV bills:

Audit your subscriptions

If you've got multiple subscriptions to various on-demand services, such as Amazon Prime, Netflix, and Sky consider whether you need them all.

Could you even just get by with Freeview, which couldn't cost you anything extra each month for TV.

Also make sure you're not paying for Netflix twice via Sky and directly.

Haggle for a discount

If you want to stay with your provider, check prices elsewhere to set a benchmark and then call its customer services and threaten to leave unless it price matches or lowers your bill.

Switch and save

If you don't want to stay with your current provider check if you can cancel your contract penalty free and switch to a cheaper provider.

A comparison site, such as BroadbandChoices or Uswitch, will help you find the best deal for free.

5. Tricks to avoid Netflix bill hikes and watch shows for free

Martin shared a number of tricks for reducing your Netflix bill after it was announced the streaming service was hiking prices by up to £24 a year.

Simply downgrading your package could save you £96 per year.

Netflix has three packages which vary in price.

The basic package, which allows you to watch on one device, costs £5.99 a month.

So if you switch to this, you'll pay £71.88 over the year compared to £167.88 with the premium package.

You can also share your subscription and even watch some shows for free, all things that will save you money on your monthly bills.

Check out all of MoneySavingExpert's Netflix saving tricks.

6. Save £1,000s on your council tax bill

Martin has urged Brits to check if they can lower their council tax bill by thousands of pounds.

People should check they are in the right band as it could be wrong.

One viewer of the Martin Lewis Money Show tweeted Martin to confirm she’d been refunded more than £1,400 thanks to his advice.

As many as 400,000 homes are potentially in the wrong council tax band, but it's worth noting that challenging your council tax doesn't always work.

It can also end up with you, and your neighbours, paying more if you're bumped up to a higher council tax band.

Here's Martin's guide with everything you need to know about challenging your Council Tax band – including the risks.

7. Your bank could owe you £100

It's not like banks to just hand out money, but that's exactly what some have been doing.

Lucky customers of HSBC, First Direct, M&S Bank and John Lewis Finance have been sent cheques for £100, £50 and £25.

Martin explained that this is not a scam and that it's an apology for poor service while they were in arrears.

The banking group is sending out compensation now until March 2021.

MoneySavingExpert have explained who might get a check and why – and what to do if you think you might be entitled to this cash too.

8. Reclaim £100s from your energy supplier

Payments could be due if your gas and electricity firm has overestimated how much you should be paying, Martin explained.

This is because most energy firms estimate how much you should be paying and then divide this amount by 12 to cover the year.

But in some cases, Martin says these guesses can be “widely wrong”.

Most read in Money

BANK FAIL Hundreds of HSBC customers left unable to make payments on first pay day of year

Flat in need of 'freshening up' goes on sale for an eye-watering price

Taxes WILL rise in April says PM as he presses on with National Insurance hike

How we bought £340,000 three-bed first home with just a £17,000 deposit

Speaking on his ITV money show, the money guru revealed how one person who tweeted him was in credit of more than £900 to their energy supplier after overpaying for 11 months.

If you’ve been paying too much, and you’re in credit to your supplier, you are entitled to ask for that money back.

Check out Martin's guide to going about getting your money back.

Source: Read Full Article